Rehabbing Homes On A Spending Plan: 9 Step Overview

How do you flip a house?

How much can you make flipping houses for a living? ATTOM Data Solutions reported that home flipping was at a seven-year low during the third quarter of 2019, but the average flip netted the seller a gross profit of $64,900, a return of nearly 41%. So, yes, you may be able to make a living flipping houses.

After establishing the objective for your residence restoration, develop a detailed plan that includes expected prices. This will certainly aid you construct a renovation budget plan and interact specifically what you want with your specialists. Developing a budget for a huge project you have actually never ever done before is an also bigger difficulty.

Residence Rehabilitation Vs Fixer Upper

Be very clear about both your job and your remodeling budget plan. If your specialist understands you're sticking to a tight budget, they will be most likely to speak through added expenses, time delays and also job changes with you. Now you recognize what you need, what you want and what you can pay for to spend for each thing. It's time to find a service provider that can finish your task within your spending plan.

If the home owner or financial institution will not sell to you for this price, leave. It's far better to maintain looking than website danger going broke from a poor financial investment. Every project is various, yet with some experience, you can find out how to estimate the costs of lots of residence renovations and also get a suggestion if a specific home is a good buy or not.

Lastly, you reach terminate home mortgage insurance policy as soon as you have 22 percent house equity. Your renovation might be too elegant or pricy for FHA standards. Or you would certainly choose a lending that does not require home mortgage insurance permanently. HUD has a helpful search page you can make use of to establish if the lending institution you wish to use has done a minimum of one 203( k) rehabilitation lending in the last twelve month. You just type in the lender name on top, scroll down and also examine package for 203( k) recovery home loan insurance program.

Not every home loan lender stems 203( k) fundings, and not every loan police officer or home loan broker comprehends the product. So you'll wish to see to it that the company you collaborate with is authorized to do this funding as well as does a lot of them.

Wintrust, however, is recognized for concentrating on rehab financings and also all kinds of financings for condominium proprietors. You'll desire to inspect out Wintrust Mortgages if you're looking for specialized care from experts that take a breath as well as live FHA finances. Hi, my name is Jason as well as I am a full-time house flipper as well as property agent. I have been turning houses because 2014 as well as to day have actually finished 14 flips. Jason is a full-time residence flipper that has been turning houses for over 5 years and also to day has actually finished 14 flips.

- Then you might end up just doing a method flip, if you're just pricing in a 10% earnings.

- I'm a licensed Real estate agent so I note the residence myself, which will certainly conserve me a little.

- Essentially you contribute all of your time and effort absolutely free throughout residence purchaser.

- The other 6% is the number I put in for shutting prices when I market the home

- A technique flip is a deal where you do not make any money.

Many thanks for investing time to curate this as well as share it with the globe. By taking these careful steps to plan for as well as reduce the price of each part of your task, you should have the ability to finish your job within your remodeling budget plan. Utilize the contractor's price quote in addition to responses to make a final update to your job plan prior to starting work to make certain the final job stays on budget plan.

How do you buy and rehab a house?

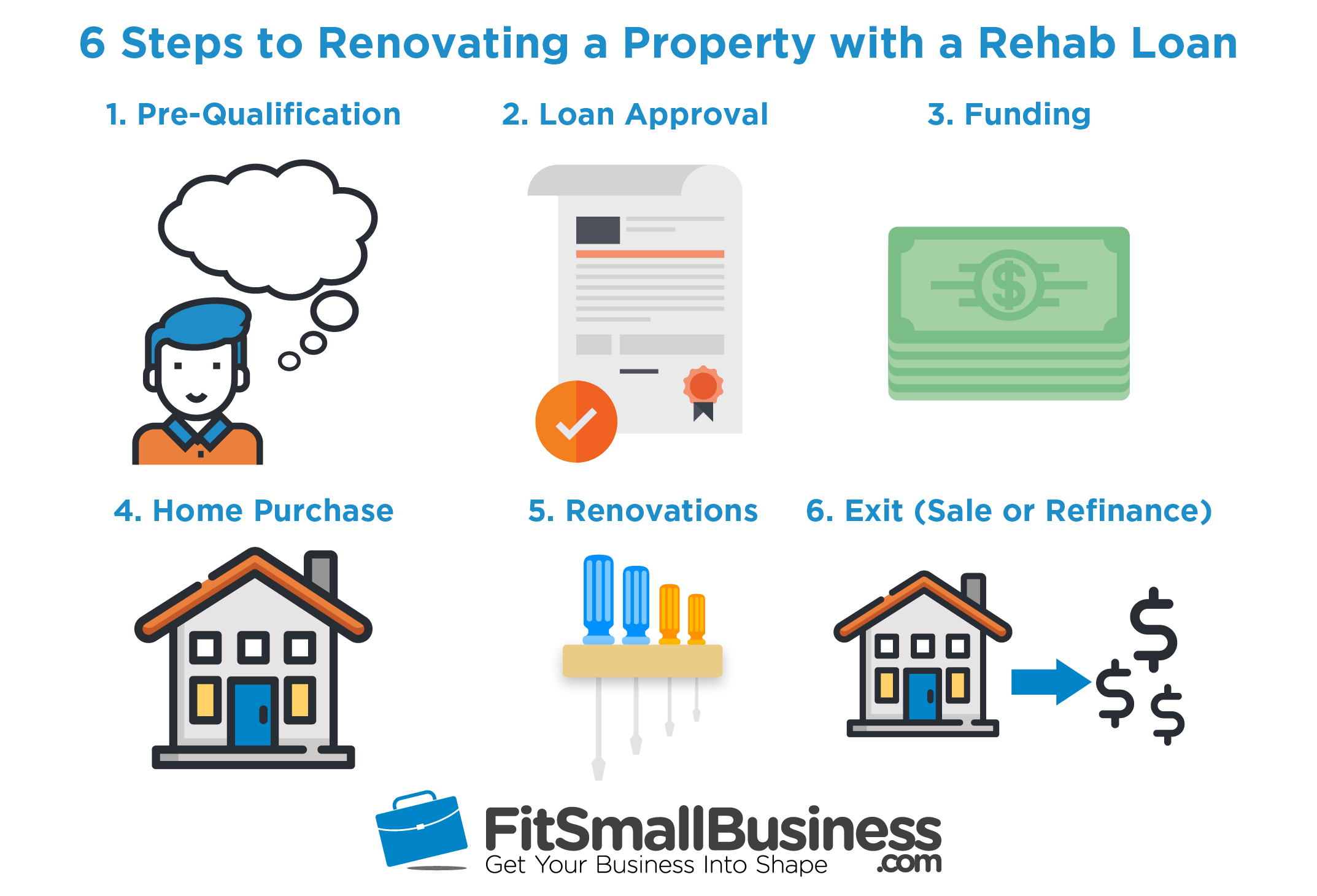

The lender funds the loan. Part of the loan funds are put into an escrow account, which holds the money for the repairs. 50% of the repair costs are issued to the contractor up front. The other 50% will be paid to the contractor when all work is complete.

In city locations, the restrictions are set utilizing "the area with the highest mean home cost within the urbane statistical area," according to HUD. In locations with reduced housing costs, the FHA limit can be as reduced as $331,760. In high-cost areas throughout the USA, FHA's financing limitation "ceiling" was boosted to $765,600 for 2020. The housing firm additionally enhanced its "flooring" to $331,760.

What does rehabbing a house mean?

Rehab mortgages are a type of home improvement loans that can be used to purchase a property in need of work -- the most common of which is the FHA 203(k) loan. These let buyers borrow enough money to not only purchase a home, but to cover the repairs and. renovations a fixer-upper property might need.

If you are not a Realtor and also you intend on employing a Realtor after that you most likely will need to budget 6% for the Real estate professional fees plus one more 2-3% for closing costs. I always expect needing to pay a few of my buyers closing prices. A bid may not change nor can repair costs increase after funding closing. Make certain your service provider has provided a solid quote and also has not underbid the task at all.

Effective fins are really critical about the homes they choose to invest in. Below's what ought to you look for in a prospective house turn. According to TIME, most financiers secure an interest-only financing, and the ordinary rates of interest for this kind of funding is 12% to 14%. In contrast, the rate of interest for a traditional mortgage is usually 4%.

How does a rehab home loan work?

A house rehab is the process of taking a property and restoring and improving upon it. This usually helps boost the property into satisfactory, or even superb, condition without drastically changing the floor plan. According to Homeadvisor.com, the national average for this type of undertaking costs $39,567.